Business owners often find that as their company grows, the number of invoices that need to be managed increases exponentially.

Without hiring additional employees, it can be difficult to keep up with the demand, leading to missed payments, duplicated invoices, and data entry errors.

These small errors can lead to big problems, including damaging vendor relationships, compliance issues, undiscovered incidences of fraud, and so much more.

The truth is, manually processing invoices at a high volume is time consuming, error prone, and expensive. Not to mention the fact that inundating your staff with redundant manual invoicing tasks day-in and day-out is generally bad for morale.

For these reasons, many businesses choose to automate common accounts payable tasks with specialized software, sending out payment reminders, generating invoices, and PO matching automatically.

Accounts payable automation helps businesses streamline their AP processes, reducing the occurrence of invoicing errors, decreasing labor costs, and freeing up staff for more important business-centric tasks.

But how do you know if accounts payable automation is right for your business? Are the benefits worth the investment?

Our guide will answer all your questions about automating your accounts payable processes, as well as provide tips and strategies that you can use today to automate accounts payable in your own company.

What is Accounts Payable Automation?

Accounts payable automation (also referred to as automated invoice processing) is the process of eliminating the manual aspects of invoice management through the use of specialized computer software.

Through a combination of OCR and artificial intelligence, automation software is able to extract information from a variety of invoice sources and validate it against business rules, before matching transactions against records from an ERP or accounts payable system.

This helps businesses automate common invoicing tasks like GL-coding, invoice approval, and invoice to purchase order matching while eliminating many of the errors typically seen when completing these tasks manually.

How does accounts payable automation work?

The best way to understand how accounts payable automation can help your business is to contrast and compare to a typical accounts payable workflow.

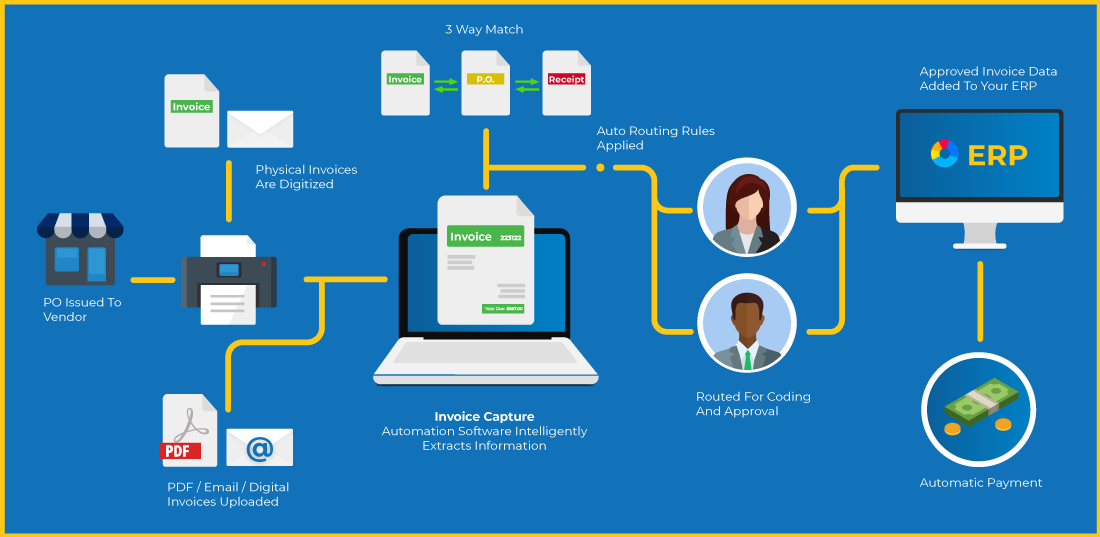

Generally, the process starts when vendor invoices are received by the accounting department. These often come from a variety of sources and must be aggregated, and in the case of physical invoices, digitized either by scanning or photographing the documents.

Invoices are matched manually with the corresponding purchase orders. Any irregularities found at this time, such as mismatched PO numbers or incorrect line items will be resolved before being forwarded for approval. This second tier of review can help prevent instances of fraud or duplicated payments.

Once an invoice has been approved by a manager or senior staff, the invoice information must be manually entered into the company’s ERP, where payments will be issued to vendors.

Frankly, It’s a complicated and unsophisticated process with a lot of mundane steps. Even when it goes perfectly, processing an invoice manually in this way takes up a lot of time and is error prone.

With automated invoice processing, the process is actually much simpler.

When a new supplier invoice arrives, it is uploaded into your AP software, either by scanning the document or uploading a digital file (like a pdf). Important invoice data, including the vendor name, total amount due, and invoice number is automatically extracted via OCR, and the invoice is converted into a text-searchable digital document.

The extracted invoice data is mapped appropriately to the ERP system, where invoices can be reviewed and approved from one centralized location.

As you can see, almost all accounts payable processes can be easily automated including:

- Extracting the necessary data from invoices

- Matching Price

- Managing purchase orders

- Initiating payment and transferring funds

- Streamlining workflows

- And more…

| Manual Accounts Payable | Automated Accounts Payable |

|---|---|

| Data is manually extracted from invoices and recorded into a spreadsheet or software by an employee. | Invoices are uploaded into your accounts payable software, where the relevant details are extracted automatically. |

| Payments must be issued manually to suppliers and vendors. | Payments can be made automatically without any manual intervention. |

| Employees must spend time following up on each invoice processed. | Notifications, follow-ups, and payment reminders are automatically sent to suppliers. |

| Processing invoices requires many manual steps that can lead to errors. | Automation ensures every invoice is processed correctly by eliminating the human element. |

| Generating invoices, PO matching, and data entry are a large part of your account payable team’s daily workload. | Processing invoices happens passively and continuously, freeing up employee time for other tasks. |

Why automate accounts payable?

Automated accounts payable processing provides a myriad of benefits to both businesses and AP departments alike. Even if your company is only handling a few invoices a month, automating your invoice processes now can help support business growth in the future. Here are just a few of the benefits of accounts payable automation:

Reduced Errors

Manual accounts payable processes can lead to costly errors, such as lost invoices, delayed or duplicated payments, and even fraud. Even the most diligent and highly trained employees can make these mistakes, after all, to err is human.

Automating your accounts payable processes can reduce your manual data entry requirements by almost 90%, eliminating repetitive and often mundane tasks typically prone to error.

Enforced Compliance

There is a ton of information flowing in and out of the average accounts payable department on a daily basis that must be properly managed. Add to that the fact that all payments received and made by the business must be tracked, recorded, and reported properly to stay compliant with all the varying rules and regulations in place.

Automated AP systems are designed to receive, process, and store invoices automatically in a manner that meets your regulatory compliance requirements. Every action is recorded and trackable, ensuring your accounts payable processes are as transparent as possible.

- Invoices are aggregated and centralized in a secure digital location.

- Access to invoices, as well as any changes made to them are tracked and recorded.

- Gain full control over who can access particular invoices, and when, based on need.

Analyze Payment Data

Analyzing your accounts payable data can help your businesses make smart choices and operate more efficiently. However, many of the valuable insights to be gained are easily lost to paper piles, spreadsheets, and other outdated accounting methods.

Automating your AP processes ensures that your organization is able to collect, analyze, and leverage your AP data for the benefit of your business. Automation can help you improve contract compliance, strengthen supplier negotiations, and save money.

Reduce Costs

Speaking of money, one of the biggest benefits provided by AP automation is the long term cost savings.

Employee time spent processing invoices, generating payment reminders, and manually keying data can get really expensive, especially when dealing with a large number of invoices. As your business grows, you may even need to hire more employees to handle the volume, which can affect your bottom line.

Automation slashes the cost of processing invoices by reducing the number of manual human touchpoints. Invoices are analyzed, categorized, processed and paid automatically, more quickly, and more efficiently than even the best AP employee.

Improve Vendor/Supplier Relationships

Vendor relationships can be one of the most important aspects of any business operation.

You count on your suppliers to keep your business up and running, and your suppliers count on you for timely, accurate payments.

AP Automation eliminates common issues that can damage supplier relationships, such as late, missing, or duplicated payments. Payments, orders, and invoices can be viewed by all parties involved at any time, a convenience your suppliers will surely appreciate.

Redirect Resources

Automating even just a few manual invoice processing tasks creates time for more important aspects of your business. By reducing the amount of time your employees spend on these tasks, you’ll be able to redirect those employees to more important causes, and better utilize their talents.

Faster Turnaround Times

AP automation will help you reduce your business’s procurement to payment cycle by reducing the amount of time it takes to process and approve invoices. Take advantage of early payment discounts when available, which can provide substantial cost savings in the long run..

Access Invoices Instantly

Working with paper invoices can be a real drag for AP departments. You may not know what stage of processing a particular invoice is in, which can make it difficult to find when you need it. With AP automation, any invoice can be located and accessed at a moment’s notice. Multiple employees can access the same file at the same time, reducing the amount of time employees need to wait around for each other during the process.

How do I set up Accounts Payable Automation?

Now that you understand the many benefits of accounts payable automation, there’s a good chance you are wondering what the process of setting it up for your own business looks like.

The good news is that due to the many different options available for businesses, near complete accounts payable automation is not only feasible, it’s affordable too.

1. Analyze your needs

Every business has unique needs, which is why there isn’t a single AP solution out there right now that is perfect for every business.

By analyzing the strengths and weaknesses of your current AP processes, you can identify areas where automation can help you streamline your existing workflow. Rather than implementing automation where it isn’t needed, focusing on areas of improvement will help you get the most return out of your investment.

2. Choose an AP automation software

When it comes to AP automation software, the choices are nearly endless. New solutions seem to hit the market every day, ensuring a multitude of options are available that can fulfill your businesses needs. Choose software that integrates well with any other management systems you already have in place, including your ERP. This will help you get the most out of your automated system and allows you to automate more.

3. Training and Onboarding

Any new system requires training for employees, and AP automation solutions are no different. Be sure to provide training and support for any employee who will be using your new AP software. Ensuring your employees are given the time they need to get comfortable with your new system which is crucial for success.

Work with an expert

The process of transitioning from paper invoices to a fully automated system can be overwhelming for any business. There are many considerations you’ll need to make along the way to ensure you get the most out of your new system, and the exact steps you’ll need to take are often unclear.

For this reason, many businesses choose to get help from a professional document management company like SecureScan. Our team has the technology, man power, and experience to help you automate your accounts payable processes like a pro. We can even help you digitize your backfile of paper invoices with our accounts payable invoice scanning service, ensuring you eliminate paper invoices from your business for good.

Contact us for more information about how SecureScan can help you automate your accounts payable processes.